The Annual Accounts are where the results for the year are bought together. The most important part of this is the Financial results - Profit and Loss - and Balance Sheet. The Profit & Loss Statement shows the income and expenses for the year to give the financial "score" or profit for the year. The Balance Sheet shows the financial "Health" of the business - the more Equity the more healthy.

From these the Income Tax Return is prepared.

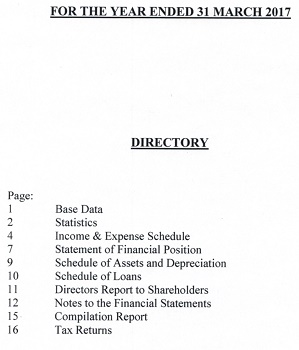

On the first page we always put the "Base Data" page - this brings together all the really important information about the business into a one page summary - IRD Numbers, names, banks, Lawyers and Accountants. Anyone who picks up your accounts can immediately see who they need to talk to.

Normally we will include a Statistical Summary showing the score and health of the entity over a number of years which is very good for highlighting trends. This can help show if things are going off the rails or (hopefully) that the business is going from strength to strength.

There will also be a schedule of assets owned by the business and the present Book Value of these assets. All part of the health of the business.

We will also put the Tax Returns at the back of the Accounts - keeping everything together.

If there is anything in these Accounts you do not understand please ask. You have paid for this report - you will get maximum value when you see how it all knits together.